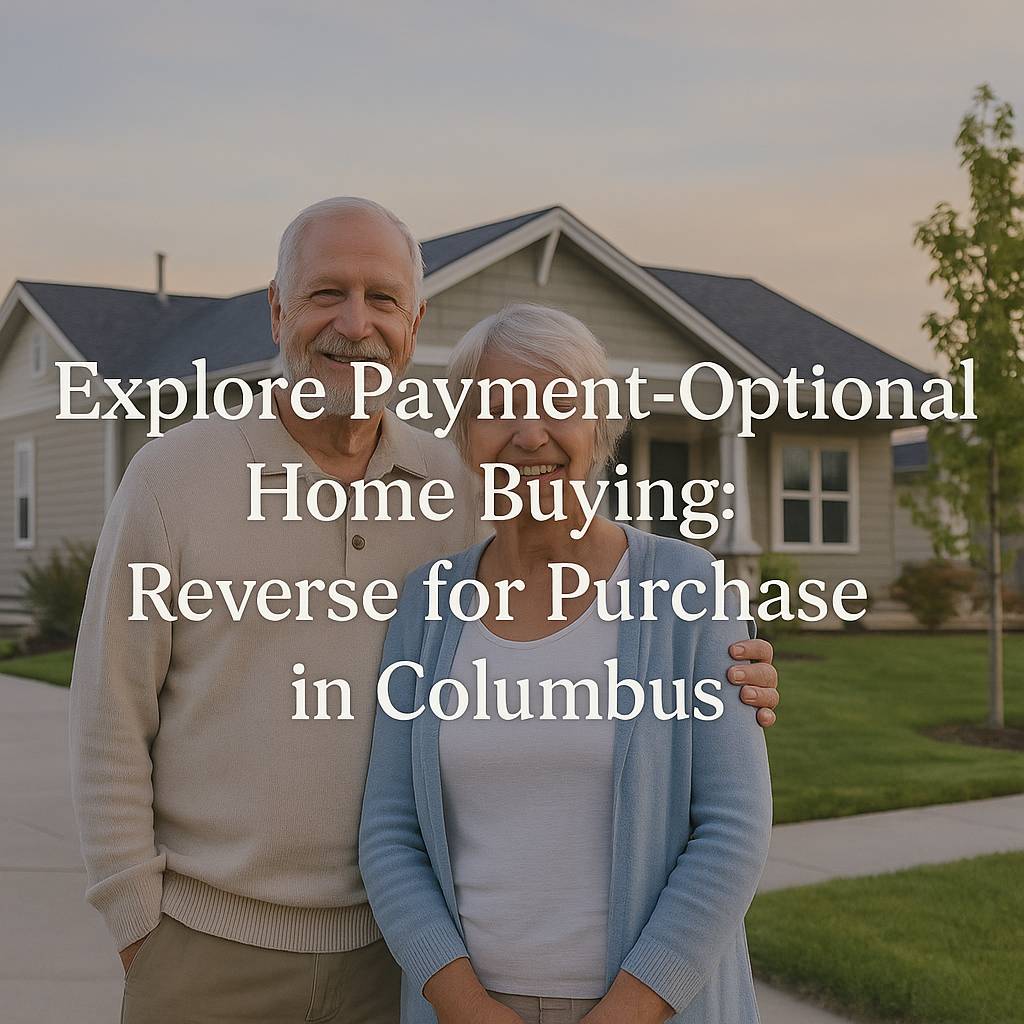

Can You Buy a Home with a Reverse Mortgage? Understanding the Reverse for Purchase Option

Learn how a reverse for purchase mortgage can help you buy a home in Columbus area 55+ communities without monthly payments.

Introduction

Ever wondered if you can actually buy a new home using a reverse mortgage? You’re not alone. Around Columbus, Powell, Dublin, and many of our growing 55+ communities, more and more folks are exploring a little-known option called the “reverse for purchase.” It’s basically a payment-optional way to buy your next home.

Section 1: What Is a Reverse for Purchase?

A reverse mortgage, or as I like to call it, a payment-optional mortgage, isn’t just for staying in your current home. You can actually use it to buy a new one. That means if you’re 62 or older, you can purchase a new home by putting down a substantial down payment—often around 50%—and then have no required monthly mortgage payments. But here’s the key: it’s optional. You can make payments if you want to pay down the loan, or you can skip them whenever you need the extra cash for something like a surprise AC repair.

Section 2: Why Consider It in a 55+ Community?

In communities like the new 55+ developments popping up around Powell and Dublin, a reverse for purchase can give you financial flexibility. Instead of tying up all your cash or dealing with monthly payments, you can keep more of your retirement savings free for other uses. It’s a great option if you’re looking to right-size into a community that fits your lifestyle without the burden of a monthly mortgage payment—or at least without being required to make one every month.

FAQs: Reverse for Purchase

- Can I really buy a home without monthly mortgage payments?

Yes! With a reverse for purchase, you have the option to make payments or skip them. If you choose not to pay monthly, the loan balance will grow over time, but you won’t be obligated to make payments. - Who owns the house in a reverse mortgage?

You retain ownership of your home. The reverse mortgage is just a loan against it. Your heirs also have 12 months to refinance or sell the home if you were to pass - Can I owe more than my home is worth?

No, you can never owe more than the home’s value. FHA insurance covers any difference if the loan balance ever exceeds the home’s value, so your heirs or estate aren’t on the hook. - What if I want to make payments sometimes?

You absolutely can. Making payments will reduce the loan balance, just like a traditional mortgage. But if an unexpected expense pops up one month, you can skip the mortgage payment and just handle your other costs. - What is a reverse mortgage and why is it bad?

It is a loan that has an optional payment with it. If you choose not to pay the payment then the interest does get added to your balance. The only reason it could be bad is if you don't understand it when signing up for it. However, now you have to get counseling now and pass tests to make sure you do understand it.

Conclusion

If you’re considering a move to one of our wonderful local 55+ communities and want to explore the reverse for purchase option, let’s chat. I’d be happy to walk you through how it works and help you find the perfect home without the monthly payment stress—or with the flexibility to pay on your own terms. Reach out today!

Sources (other than me 😄)

- Federal Housing Administration (FHA) – Reverse Mortgage (HECM) overview

Link: FHA – Understanding the Reverse Mortgage FHA.com

Why include: Explains what a reverse mortgage is, how it grows (loan balance increases over time) and gives official definition. - FHA – Reverse Mortgage Requirements

Link: FHA Article: How to Qualify for an FHA Reverse Mortgage (HECM) FHA.com

Why include: Details the eligibility criteria (age 62+, primary residence, etc) — useful for your FAQ and to show credibility in your post. - Consumer Financial Protection Bureau (CFPB) – Reverse Mortgage Discussion Guide

Link: CFPB Reverse Mortgage A Discussion Guide Consumer Financial Protection Bureau

Why include: Useful for myth‑busting and explaining how reverse mortgages differ from regular ones — good support for your “you retain ownership” and “you’ll never owe more than home value” claims. - HECM for Purchase (Reverse Mortgage for Buying a Home)

Link: Reverse.Mortgage – 2025 Guide to Reverse Mortgage Purchase (H4P) All Reverse Mortgage

Why include: Directly supports the premise you’re emphasizing (buying a home with a reverse mortgage) — perfect for your “reverse for purchase” section. - Investopedia – HECM for Purchase & Reverse Mortgage Basics

Link: Investopedia – HECM for Purchase Investopedia

Why include: A clear third‑party explanation of the buying option, down payment typicals, how the loan works. Good for reinforcing your optional payment, ownership, and insurance points. - Federal Trade Commission (FTC) – Reverse Mortgages Consumer Advice

Link: FTC – Reverse Mortgages Consumer Advice

Why include: Offers best‑practice advice and warns of common misconceptions — helpful when you’re tackling the myths about reverse mortgages.